Is hiring and purchasing a car a good option to get a car? Buying a car is one of the achievements that almost everyone wants to achieve in this lifetime. But, how possible is this when the factors of money and inflation in Nigeria and all other countries around the world are affected? Car manufacturers are, at the end of the day, duly affected by this, which makes the possibility of getting a cheap and affordable car a slim chance nowadays.

Table of Contents

In retrospect, we cannot blame car sellers for this fit because they themselves have to make a profit and cannot ideally sell a car for the same price they initially paid; in the case of private sellers, we mean. If you buy it directly from the dealership that deals with that specific car brand, then you might be in luck to get warranties and bonuses, but that won’t invariably affect the car price, and in some cases, it might increase it. How does hire-purchase help in this situation?

Look at this scenario: a 2007 Toyota Corolla sells for N2,500,000–N3,00,000. On the surface, the price has recently inflated, and one might find it difficult to afford. We would like to highlight that this is the base price for the Tokunbo; the newest model for a Toyota Corolla is well into N15,000,000.

The heart palpitations at this price are very astounding. The crux of the story is that most people might find it hard to afford both the 2007 Toyota Corolla and the 2022 model. This is where hire-purchase comes into the picture to help solve this problem. So, before you get into any hire purchase agreement and how much you would remit to them, you would need to read this article for a better understanding.

What Is a Car Hire Purchase?

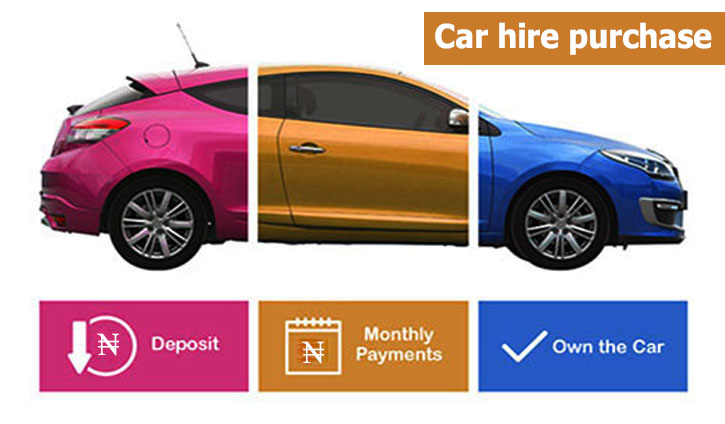

In the layman’s sense, a hire purchase occurs when you deposit a particular amount of money for a car of your choice, in which case the car is put in your possession while you make payments either weekly or monthly to offset the remaining cost of the car. One important feature of hire-purchase car agreements is that the cars involved are usually tokunbo, which are gotten from a private seller and not usually a dealership. This doesn’t adequately mean that dealerships aren’t into hire-purchase agreements, but private sellers of cars are more notable in this regard.

One thing to note is that hire-purchase is not a car loan or a car rental. In this case, the point of this kind of agreement is to offset the initial value of the car and become the owner. This means you only have a possessory interest in the car until the car is paid in full. Most people get involved in hire purchase agreements if they want to begin a car-hailing business such as Uber or for interstate travel, or if they just want an easier means to purchase a car of their choice. For hire-purchase agreements, you will be asked to pay a 10% initial deposit of the determined car price; if the price of the car is N1,500,000, you would pay N150,000 in the first case.

This doesn’t mean you won’t be asked for a higher initial deposit, but 10% is the starting point. But, before you get into this aspect, you would need to ask the seller how far the payments would be spread, whether over 22 months or 24 months and how you would be paying: either weekly or monthly. We advise you to push for monthly instalments, as you would get more time to meet the target price. If this has been agreed upon, you would need to know how much you would be paying in interest, if applicable. Also, the need to know how much you would be paying monthly is very important so that you can know how long you would be paying.

What Are The Benefits Of Car Hire Purchase?

One of the reasons people opt for hire purchase rather than loans or some other form of security is that it allows for a flexible form of payment that can be spread between one and five years as it is a large lump sum.

As mentioned, your initial deposit would be low, as most of the time you would be paying just around 10%–15% of the value of the car you want to buy. What this means is that if you plan on getting into the ride-hailing business and you don’t own a car, you can decide to use hire-purchase to get started. If the value of the car is estimated at N1,700,000, your initial deposit may begin at N170,000 or higher. While you and the seller meditate on how much you would be remitted back to him monthly to offset the balance, You don’t need much capital in this regard.

Another plus for car hire purchases is that there is a slim possibility that after you have paid half of the payment for the car, you might be allowed to return the car without paying more for it. This can work in some ways if the car has developed some faults and keeps giving you issues, and you have visited the mechanic shop quite a number of times.

But, you need to keep in mind that when it comes to this aspect, you should state it clearly in the agreement so as to avoid any issues with the seller. This doesn’t mean that as soon as the car develops a fault, you should immediately return it; what it means is that it should be continuous and not simply the result of your own driving. This is why car inspection is so important.

What Are The Disadvantages Of Car Hire-Purchase?

Like almost every other form of security, you don’t own the car until you have made final payments to offset the balance of the car and the title has been passed to you by having all the necessary documents in your name. What this means is that, if a time comes that you aren’t able to fulfil the financial requirements of the agreement, the car can be taken away from your possession and you won’t be able to do anything unless you remit the balance owed. At the end of the day, the car isn’t yours until you pay off the balance.

The process can be both short-term and long-term. What this means is that, if you decide to go the short-term route, you would pay a higher deposit in the first instance, and the monthly instalments would be much higher. If you run into any financial difficulty within this short-term period, the car can be taken away from your possession in this regard. While long-term periods are ideal for those who are within financial constraints, they pose an issue, especially as regards the interest rates you will be paying. Due to inflation and other circumstances, your interest rate might increase substantially.

Another issue to take note of is that you can’t make any modifications or fix any significant part of the car without first seeking permission from the seller. What this means is that any substantial repairs on the car can’t be done without seeking permission from the seller, and if consent is obtained in the affirmative, the burden of fixing the car falls on you unless the agreement says otherwise.

Final Verdict

Car hire-purchase is the way to go if you are on a low financial budget and want to get the car of your choice. If you are in need of a new or used car, why don’t you check out Carmart.ng to see the best car choices to suit your needs at any budget?

Have 1 million naira and above to Buy or Sell Cars In Nigeria? Check carlots.ng

All rights reserved. Reproduction, publication, broadcasting, rewriting, or redistribution of this material and other digital content on carmart.ng is strictly prohibited without prior express written permission from Carmart Nigeria - Contact: [email protected]