Car Hire Purchase – Owning your car should not be a case where you have to empty your bank accounts just to get a car, though a car is an expensive property. A lot of people have experienced bankruptcy just to pay for a car they need, and this should not be the case. As a result of this, a car hire purchase service should be used. Hire Purchase simply means buying a good or property and paying for it in instalments. You don’t have to pay for it all at once, but the total money can be split into smaller part payments to allow ease of repayment.

Table of Contents

Many people dream of becoming car owners in Nigeria, but paying for a car in one sitting is a luxury, especially knowing the economic situation Nigeria faces. So, what is the best way out of it? The best way out of it is by buying a car through the Car Hire Purchase method. The necessity of a car in Nigeria cannot be over-emphasized, because it is needed for daily commuting especially if you live in a city like Lagos in Nigeria.

If you are interested in learning about how to buy a car using the Car Hire Purchase method, then stick through this article to guide you.

First, what is a Car Hire Purchase?

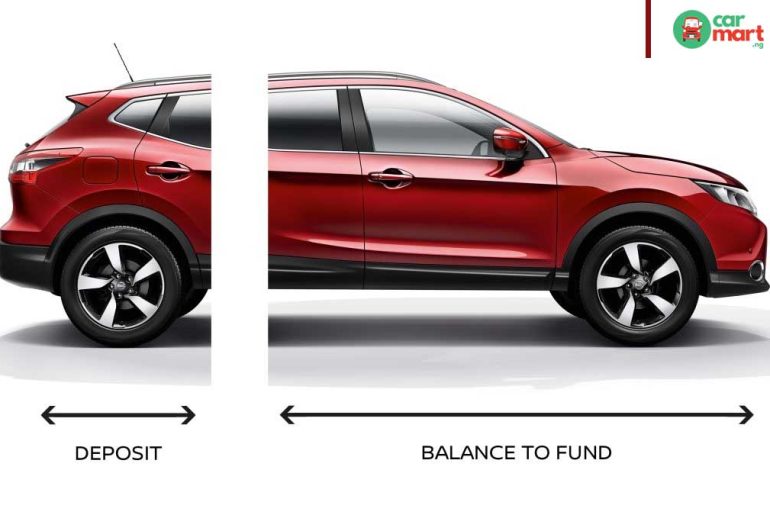

Car Hire purchase, simply put, is a process where you buy a car with an agreed plan to repay the total money of the car over a period of months or years, depending on the agreement. Hire purchase is an approach to fund purchasing a new or utilized vehicle. You (generally) take care of a deposit and pay the estimation of the vehicle in regularly scheduled payments, with the loan made sure about against the vehicle. This implies you don’t claim the vehicle until the last instalment is made.

As a rule, you first need to put down a deposit on the vehicle you need to purchase. This is generally 10% or a greater amount of the vehicle’s value. The rest of the estimation of the vehicle will at that point be paid off in portions over a time of 12 to 60 months (one to five years). Hire purchase is orchestrated by the vehicle seller, yet online stores or physical stores likewise offer this service. The rates are serious for new vehicles, but less so for utilized vehicles. For recycled vehicles the yearly rate can shift from 4% – to 8%; the lower the number the better. The rate could be higher for instance since you don’t have a decent financial assessment.

The advantages of Car Hire purchase

- 1) Flexible reimbursement terms (from one to five years) to help fit in with your month-to-month financial plan.

- 2) A relatively low deposit is required (ordinarily 10% of the vehicle’s cost).

- 3) Fixed loan fees so you know precisely what you’re paying each month for the length of the term.

- 4) Once you’ve paid a large portion of the expense of the vehicle, you may have the option to restore it and not need to make additional instalments.

The disadvantages of Car Hire purchase

- 1) You don’t claim the vehicle until you’ve made your last instalment, which implies in the event that you get into money-related challenges the fund organization could remove it.

- 2) You can’t sell or adjust the vehicle over the agreement term without getting authorization first.

- 3) Your deposit and term length will influence your regularly scheduled instalments. Your regularly scheduled instalments are probably going to be higher the more modest the store is and the more limited the term of the credit.

- 4) Until you’ve paid a third of the aggregate sum payable the moneylender can repossess the vehicle without a court request.

- 5) It can be a costly course on the off chance that you just need a momentary understanding.

Also Read: How To Get A Car Loan In Nigeria – Top List Of Auto-Finance Companies

How to get the best Car Hire purchase deals

There are two main options here:

- Get the funds through the vendor you’re purchasing the vehicle from.

- Getting funds through an online merchant.

It’s necessary to look through online first so you’re outfitted with certain numbers to wrangle within vendors. Offers can fluctuate fundamentally on the internet and in businesses so getting more than one financial quote is of important.

To assist you with contrasting the various offers request vital information like:

- The APR you’ll be paying

- The aggregate sum repayable

- The complete expense of credit

- Any extra charges.

Independent dealership for Car Hire purchase

At the point when you purchase a vehicle, you’re probably going to go to either an independent vendor (one that is controlled by a business and will stock vehicles from numerous brands).

Independent sellers will have a more extensive selection of vehicles, as it’s a lot simpler for them to stock various producers. You’ll additionally discover generally recycled vehicles, which implies normal vehicles are less expensive. You won’t typically have the option to discover 0% account arrangements or enormous store commitment arrangements, and APR will associate with 5-10% – despite the fact that your credit record will influence the rate you’ll have the option to get.

Diversified vendors are the spot to go for another vehicle – despite the fact that recalled new vehicles lose their incentive because of rapid devaluation.

List of Car Hire Purchase Companies in Nigeria

Some Car hire purchase companies around big cities in Nigeria include:

Citrans Global Limited

- Contact: 07000733222

- Address: 72 Otunba Adetoro Drive, Off Lekki Beach, Lekki, Lagos

Rhezon Car Rental

- Contact: +2348039662017

- Address: 1 Aguiyi Ironsi St, Maitama 900271, Abuja, Nigeria

Jimak Tactiq Integrated Services Limited

- Contact: +2348096000112

- Address: No 6 Bolton Street Suncity Estate, Abuja, Nigeria

C & I Leasing PLC

- Contact: +23498705633

- Address: Suite 17, 4th Floor, Metro Plaza, Zakariya Maimalari Street, Central Business District, Abuja, FCT

Gabrich Group

- Registration No. 1815026 and Tax Identification No. 23961967-0001

Gbovo Transport

- Address: No 32 Aina Ijayi Estate, Ekoro Rd, Abule Egba, Lagos

- Phone: 0706 237 1791

PUKENA Technologies Ltd

Pukena, Lekki Office

- 2nd Floor Providence House, Admiralty Way Lekki Phase 1

- Lagos, Nigeria

- Tel:+2348168411237

Pukena, Mainland Office

- 371 Borno Way, Spencer, Yaba, Lagos, Nigeria

- Email: [email protected]

Lecon Financial Services Limited

- Contact: +23496708714 or +23498700853

- Address: 256, Zone AO, off Herbert Macaulay Way, behind Unity Bank building, Central Business district, Abuja FCT

What are the disadvantages of hire purchase?

the car will cost more.

Monthly payments are based on credit rating

It can be expensive for short-term agreements.

Missing or late payments could affect your credit score.

How can I get a hire to purchase a car?

What is the difference between hire purchase and leasing?

What is hire purchase with example?

Conclusion:

It is necessary to note that a Car Hire Purchase service is different from a car rental service. Also before deciding on the company you may want to use, it is important to conduct in-depth research on the mode of payment, interest rates, and all other necessary information.

Have 1 million naira and above to Buy or Sell Cars In Nigeria? Check carlots.ng

All rights reserved. Reproduction, publication, broadcasting, rewriting, or redistribution of this material and other digital content on carmart.ng is strictly prohibited without prior express written permission from Carmart Nigeria - Contact: [email protected]

102 Comments

Thank you so much for sharing this blog it was nice and useful

My name is Samuel. I need corolla 2004-2006 or Honda civic (discussion continue) 2006-2007. On higher purchase for bolt in Abuja. I promise to be promt, honest and efficient in payment and the terms and condition.

I’ll be glad if there’s anyone who can help me. Thank you

08063436106 is my phone number. Thank you

I need a Toyota sienna for installment I will be paying every month end ,no disappoint please anyone to help me please God will bless you.

Please I need a help of Toyota sienna for installment I will be paying every month end without disappoint I promise ….08169359972 is my phone number

My name is Emmanuel Ochube, pls I need corolla 2004 to 2010 for BOLT in abuja… Anyone available can contact me 08174251020

Please I need a toyota sienna car for an installmental payment be it monthly or weekly payment. please u may determine the route with which u’ll want me to be using it during the duration of my payment. Anyone that can assist me with this can contact me : 07059002001.

Thanks

I need a car or bus for hire purchase. My phone number is 08022949715. I live in Calabar

Please I need a car for my Delivery and into logistic I will be paying weekly I will appreciate if you can help me please

I need a car on high purchase, for bolt please contact me on 08104643683 if there is any, I will pay as agreed. Thanks

My name is kadri a family man of 3kids I need a sienna bus 2007/2008 model for higher purchase I promise to fulfill all the requirement within the period I reside in lekki Ajah area of Lagos this is my contact 07088062355

I’m folorunsho I reside Lagos with two kids, I need a car for Uber in hire purchase, here is my WhatsApp 08180376150.

Please I need Toyota Corolla 2008 for high purchase I will be paying every month here in Lagos please if anyone can help me

I need a hire purchase corolla for uber and blot….contact me on 08025948003

My name is Jerry Moses I am from lagos I need a hire purchase Toyota Corolla for Uber

I promise to be honest and pay asap

08032487785 is my contact

Hello my name is Friday I’m from Abuja Nigeria I’m gbagyi by language I need a Toyota Corolla 18 for hire purchase agreement on the payment through I will be humbled by your themes and conditions sir

My phone number or WhatsApp

09160902515

07019057740

Thank you and God bless you more sir

Pls I need a Toyota Corolla for bolt..on a hire purchase, I stay in kubwa… Abuja..

08132801181..pls if available kindly contact me..am very much interested

Pls I need a Toyota Corolla for bolt..on a hire purchase, I stay in kubwa… Abuja..

08132801181..pls if available kindly contact me..am very much interested

I need anyone of Hummer Bus Toyota, Toyota Sienna bus,or Mini Bus, on Hire Purchase, please anyone that can afford to help me,I will be grateful and promise to be honest and straight forward,, Will not dissapoint on payment plans, please help me,I am residing in Aba Abia State,08164554915

Please I need a help of Toyota sienna for installment I will be paying every month end without disappoint 09021072491

Good day am into business that gives me alot of sper time . I would love to invest my sper time into Bolt . I am based in Lagos and I will not disappoint . This is my number 09137580309.

I am Stephen from warri Delta State (NG)

Please i need a Toyota Corolla from 2010-2015 on a hire purchase for bolt drive,i promise to be honest,i will pay weekly aggregate amount…….

My mobile number is 08103800122/08087874031

Pls help…..

Good day am into printing business,since the opening of the lock down,my business is not stable again,infact I have lost my office.this is my five months I have been looking to get a Corolla Camry 2005 car for hire purchase or delivered to start Uber and Both.pls I am interested in your hire purchase,if I found one.(08146347170).thanks

My name Uchechukwu Dominic

A student of national open university of Nigeria (imo state chapter) I have lots of free time and really want to go into transport business ad Urber but haven’t got a

Will appreciate any dealer that can sell a car to me on hire purchase

I promise to be honest and stick to the payment terms

Can contact me on 08068433198 (calls)

Pls I need Toyota corolla for bolt hire purchase or weekly deliver am in Lagos pls call (07025092915

Please I need Toyota previa 2005 model on a higher purchase if anyone can help I will be very happy and I promise to keep to the terms and conditions thanks

08158126805 or 08032941849

Please I need Toyota sienna of a good model for transport business, on hire purchase. . I promise to keep to the terms and conditions applied.

I need corolla 2012 Le for hire purchase this is my contact 08134008577

Good day am into business that gives me alot of time . I would love to invest my spare time into uber/Bolt . I am based in Lagos and I will not disappoint . This is my number 08081586854

Need a Toyota Camry on higher purchase to do uber here’s my number 08052347116

I need a Toyota Camry car for hire purchase, my number is 07059579374

Please I need a Toyota Corolla sports on higher purchase in Lagos 08136790030

Please I need corolla If it’s rental or hire purchase

I reside here in Abuja. I’m looking for a car for HP for BOT services . corrolla to be precise. should anyone find me worthy, they can contact me via this 08174495084

Good Day,

Please I need a Toyota corolla 2010 – 2015 for hire purchase. All agreement will be accepted. Am in Lagos, thank you. 08078133451.

Am a God fearing person, I learnt that you have a car to give out for Uber driver as a source of income. Just taste me and see that Abiodun is good. Thank you

Good day my name is okpara samuel I base in Abuja fct. If I can get a golf3 for hire purchase I will be grateful here are my contact 09028342019 or 08188200193 thanks

How can I get corolla LE 2012 or 2013 model for hire purchase

Am in bwari Abuja..am ready for any agreement.thanks

I need a car for higher purchase which i can use for uber work my phone no:07031287037

Hi good day my name is mayowa pls I need a Sienna 2007 model I live in FCT Abuja EFAB MERTROPOLO TUNISHI Street house 9 this is my 08051305266 thank you

Gud evening.

Pls I am in serious need of Toyota Corolla for Uber i would be glad if I get help

Pls am in need of Toyota Corolla for Uber i reside in Lagos and I promise to be very prompt with payment..

My number is 08103181113

Thanks

Hello.

Im in need of a car to use for Bolt here in ABUJA at an higher purchase deal.

I promise for a swift monthly/weekly payment.

Below is my number (call/ WhatsApp)

07062850238

I need a hire purchase car for cab here is my number 09072729622

Pls i need a toyota corolla car for uber taxi on hire purchase.i base in lagos 08085433313

My name is chikamadu nwogu, Please i am a bolt driver but i don’t have a car at the moment, someone should kindly help me 07081344010 i live in ajah lagos

I need a Toyota sienna on hire purchase for commercials such as long distance travels,akwa ibom to Lagos,Lagos to Abuja,East to North as the case may be,I am a graduate of Heritage polytechnic from the department of mass communication,I could give an almost equivalent collateral to show my level of sincerity thank you so much sir/ ma my name is Anietie Jacob Isaac 08118120830

Please I’m interested in Toyota sienna (7 seater) of a good model for transport business, on hire purchase monthly payments. . I promise to keep to the terms and conditions as would be agreed.

Below is my contact

08162935660

I reside here in Abuja. I’m looking for a car for HP for BOT services . corrolla to be precise. should anyone find me worthy, they can contact me via this 08174495084

I need Toyota Hiacentre van for higher purchase, I promise to be faithful

Am very much interested I Toyota camry 2006 for hire purchase, i promise not to see default. God bless

08058734102

My name is Emmanuel, pls I am very much interested in Toyota corrola for transport business, I am based in Lagos, and I promise to be faithful and not default. Thanks

08112789289, DALUMO SAMUEL IS MY NAME I NEED A TOYOTA CAMRY 2007 MODEL MOSUL FOR HIGHER PURCHASE

I need hire purchased car for Uber…

Please I need a Toyota sienna to run transportation here is my number 08165054306

PlS am interested in Toyota corola, 2010,, 2008 for hire purchase. My contact 09033783745. Thank you

Please I need Toyota Camry 2005 for higher purchase I want to be using it for uber l reside in ibadan

I need Toyota Cesena for transport, I live close to Ogun state.

My name is martins odigbo I reside in aguda surulere Lagos state, please I’m in urgent need of a car on a hire purchase for uber/bolt this is my number you can reach me on 07037586413 or [email protected] I will be glad to get a feel from any one thanks

I need a Corolla Camry 2005model for Uber with hire purchase….

Hi Pls I need Toyota Camry for Uber in Lagos for hire purchase pls this is my number 09033950574

Hi please I need Corolla 2002-2004 model for Bolt for hire purchase in Ibadan 07033721350

Pls, I need a toyota corolla 2009 for HP.this is my number-08035154757

please need a toyota camery 2009 or lexus 330 saloon for hire-purchase”07062206740

I am based in Awka, Anambra State, I need Toyota Corolla or Camry (Big Daddy) for Bolt and Airport Taxi on Hired purchase.

Anyone to help I will appreciate it to much.

My name is David Archibong

.please I need a bolt/uber standard car for hire purchase weekly Installment my number is 07038596454 lagos thank you

Am Mr James Christian based cross river state I need a Toyota Corolla 2010 to 2015 for daily remittance,,,, only in cross river state my phone 08107700258 thanks in advance

Am alebiosu yusuf staying in lagos I need a car Toyota camry for Uber 2008 – 2015….. 08189315145 ….thanks so much in advance

I am Bode Oladeji based in Jos, Plateau state. I need a Toyota Corolla or a Toyota Sienna on a hire purchase for commercial transportation. I promise to be honest and prompt payment. I will be paying the agreed amount weekly. My mobile number is 08111082550. Thank you.

Good day. My name is Sunday, a yoruba man from Osun, living in Lagos, I need Toyota sienna 05 for hire purchase within 18 months of payment, I can do weekly insurment or monthly. Thanks. My number 08036431363

Mr Alfred Chigozie I need a Toyota corolla 2005 for hire purchase tokunbo am in Lagos.

My name is Peter. I am based in Ojodu- Berger, Lagos. I need a Toyota Corolla (2005 – 2012) for hire purchase. I will really appreciate a kind hearted Nigerian out there. My phone number (or WhatsApp) is 08099617810. Thanks.

Hello greetings, I’m desperately in need of a Toyota Corolla on Hire Purchase, please anyone that can afford to help me,I will be grateful and promise to be honest and straight forward, I Will not dissapoint on payment plans, please help me,I am residing here in Abuja.Here is my mobile contact as well 08162680920 .Thank you so much, and God bless you.

I need a Toyota corolla 2011 or 2012, I stay at akowonjo lagos. Hire purchase

I seriously need a vehicle to start transportation business with Uber or any I need car loan for the car purchase pls help me 08071322260

Hello greetings, I’m desperately in need of a Toyota Corolla on Hire Purchase, please anyone that can afford to help me,I will be grateful and promise to be honest and straight forward, I Will not dissapoint on payment plans, please help me,I am residing here in lagos state.Here is my mobile contact as well 08032640398 .Thank you so much, and God bless you.

Gud morning sir,/ ma my name is Sunday Joseph I stay in Nasarawa state am in need of car Toyota matrix or Pontiac vibe on Uber or blot for higher purchase pls anyone who can help me should pls come to my aid bcs it has not been easy. But I promise anybody willing to help dat bye God’s grace u won’t regret helping me 08069225587

Good morning sir /ma, I’m David my name… Pls I need a Toyota corolla for hire purchase pls asap 08162076149

My name is Adekpe Monday I need a Nissan primera for hire purchase. I lives in ajah Lagos

This is my phone number 08131506086

I need very good Corolla range from 2006-2008 for hire purchase.

Any available dealer should reach me via call or Whatsapp

08161883838.

Please i need tokunbo foreign used toyota corrolla wagon 2013 model for hire purchase installmental, this is my nos 09034802639 please any good dealer im available.

I need a car on high purchase, for bolt please or cienna car for logistics work contact me on 08060960835if there is any, I will pay as agreed. Either daily or weekly or every end of the month Thanks

Rasaq

I need Car in hire purchase for ulber or bolt I will pay back as agreement if any contact me on 09124747819

Please I need a 2006 Corolla on hire purchase for bolt business. I live in Benin city, 07040281504

Hello please i need a hire purchase for a carb

This my number 08168379648 thanks

Hello

Good evening sir/ma please I’m in need of a hire purchase Toyota corolla 2012/2013 for bolt please hire purchase installmental please this my number 👉👉07083835877 please reach out to me very important God bless you

Good evening everyone please I need a hire-purchase for Toyota Camry or Corolla for bolt quick delivers ( 09019075640)

I stay in Lagos mainland

I need a hire purchase car 2005 corrola worth of 3million urgently .am a working class, just need to augment my income. I can be reached on 08065000460 am based in Abuja. Tanks in anticipation 🙏

Good sir/ma’am I have Uber bolt and Indriver app if possible I need a car for hire purchase weekly payment with out any I have everything u need I stayed in Lagos with my family 07037355737

I need a car for Uber on hire purchase can anyone help me on that please

My name is chibuisi kalu

I need a car (Camry 2.4 or Corolla) for bolt on hire purchase

I’m in owerri Imo State

My phone number are

07067595987

Thanks

My name is Chinonso okorie Oji I need a car for higher purchase Corolla 2004 to 2010 model to be paying on monthly basis I reside in Rivers State and I want to use it for bolt I promise not to go against the agreement.

08061377249

Hello, My name is Adesina Bidemi John, I need a Toyota Corolla car 2006-2008 preferably but I wouldn’t mind any other year, for hire purchase,

for Uber/Bolt business.

I reside in Lagos.

contact; 08026185864 (WhatsApp and call). Thank you in anticipation.

Goodming I need hire purchase Seine or bus this is my 08105769516 or 07083767843 I reside in Delta stete warri

Pls my name is damilola i need toyota corolla or camry for my uber business i leave in ota ogun state

Good evening i need toyota corolla le my my uber business

I need toyota corolla le for my uber business. 07068942173

I need a Toyota car bus from Iwo, Osun State. Kindly send me the number to contact for proper negotiation. Thanks

Good day ma/ sir

My name is Julius, I base in Abuja . Maitama extension to be precise .

Please I need Toyota Corolla 2009 white or black for hire purchase.

Below is my contact number and WhatsApp in which I can be reached .

08069126037

My name is Giw, Please i am a bolt driver but i don’t have a car at the moment, someone should kindly help me 08028152073 ; i live in Festc lagos

My name is asuquo okon,an automobile engineer studied in India. I want a hire purchase minibus for a transport service. My phone number is :07066667325. I need it urgently.