One of the major beliefs of many Nigerians is that getting car insurance is all sweet and rosy until it gets to the point when it’s time to make an insurance claim. The insurance claim stage of getting car insurance is one of the things many car owners worry about.

Table of Contents

Understandably, the process involved often fazes most car owners. But note that it doesn’t mean you won’t get the claim. It only means you are required to follow due process. You will be informed about this from the moment you purchase an insurance premium.

Now, imagine you’ve had a car accident or hit someone with your car, and you have an active car insurance policy. How do you make a claim for the accident damages?

Before we discuss the steps to follow, note that it’s important to know that your insurance policy covers that particular claim. If your insurance policy does not cover car accidents, damage, or death by accident, your insurance provider won’t pay for that.

However, if it does, here are the steps to follow to get your insurance claim.

Step 1: Contact Your Insurance Broker

The first thing to do once the accident occurrence has died down a bit is to phone your insurance broker. Every insurance company provides customers with an insurance broker. Like a line manager that you directly contact when you need to make a claim.

The responsibility of your insurance broker is to direct you on what to do before you move on to the next step of making a claim.

Step 2: Allow the Insurance Company to Conduct an Investigation

Once you’ve made a claim, your insurance company will take a while to investigate your claim. The reason is to verify the information and avoid fraudulent practices.

It’s during this process that they determine the extent of the car accident damage and then compare it with your insurance policy. The investigator also looks into all third-party issues involved. To help this process, it’s important to have a witness. Once it’s been confirmed, the next step is activated.

Step 3: Thorough Review of the Car Insurance Policy

Once the damage has been determined, the insurance provider goes back to the drawing book to compare your insurance policy with the extent of the damage. During this process, they look at your insurance coverage and determine whether or not it covers the issues that arose through the accident.

Step 4: Damage Evaluation

For car accidents, the insurance company hires automobile experts who help them determine the entire cost of repair. Once it’s been completed, your insurance company will provide you with a list of car repair parts vendors that will handle the repair.

Step 5: Claim Payment

First, note that insurance payment for a claim only covers what is in your insurance coverage. For instance, if you have a car damage issue of N1,000,000 and your coverage only covers N350,000, that’s what the insurance company will pay for, while you cover the rest.

Once the process has been completed, your insurance provider contacts you regarding the payment and provides you with various payment options. The time it takes before it gets to the payment stage depends on the extent of damage and your insurance company’s protocol.

How To Lay a Claim for a Third-Party Car Insurance Policy

In Nigeria, most drivers only have a third-party car insurance policy. If you’re to make a claim with third-party insurance after an accident, here are the steps to follow:

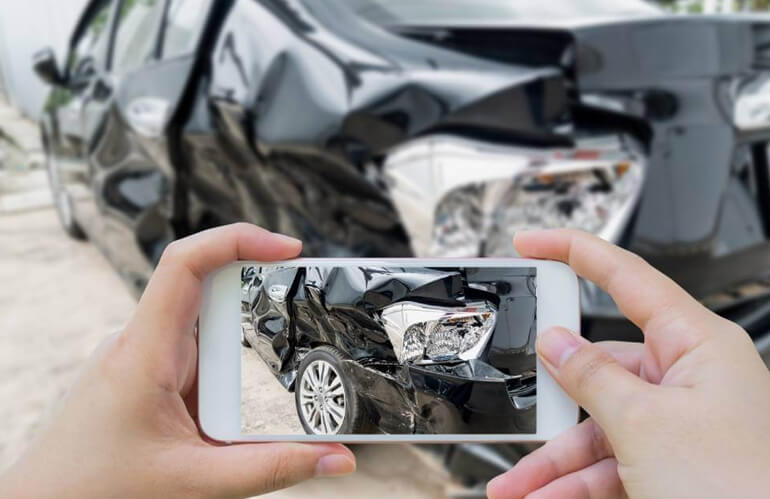

- Make a claim against the other driver with valid evidence (pictures & videos). It helps the insurer determine who’s at fault. If you’re at fault, then you’ll pay for the damages of your own car.

- State in writing that you want to claim from the other driver. Also, write to the owner of the driver’s vehicle if the driver doesn’t own the car.

- Inform your insurer through your agent and explain what happened.

- Request that the other driver contacts his insurance provider

- The insurance company carries out investigations and follows the steps above.

Conclusion

It’s possible to get claims for car accidents in Nigeria. You have to ensure your policy covers the damages that occurred and follow due process to file your claim.

Have 1 million naira and above to Buy or Sell Cars In Nigeria? Check carlots.ng

All rights reserved. Reproduction, publication, broadcasting, rewriting, or redistribution of this material and other digital content on carmart.ng is strictly prohibited without prior express written permission from Carmart Nigeria - Contact: [email protected]